Hybrid Solutions for a Hybrid World: Windows 365

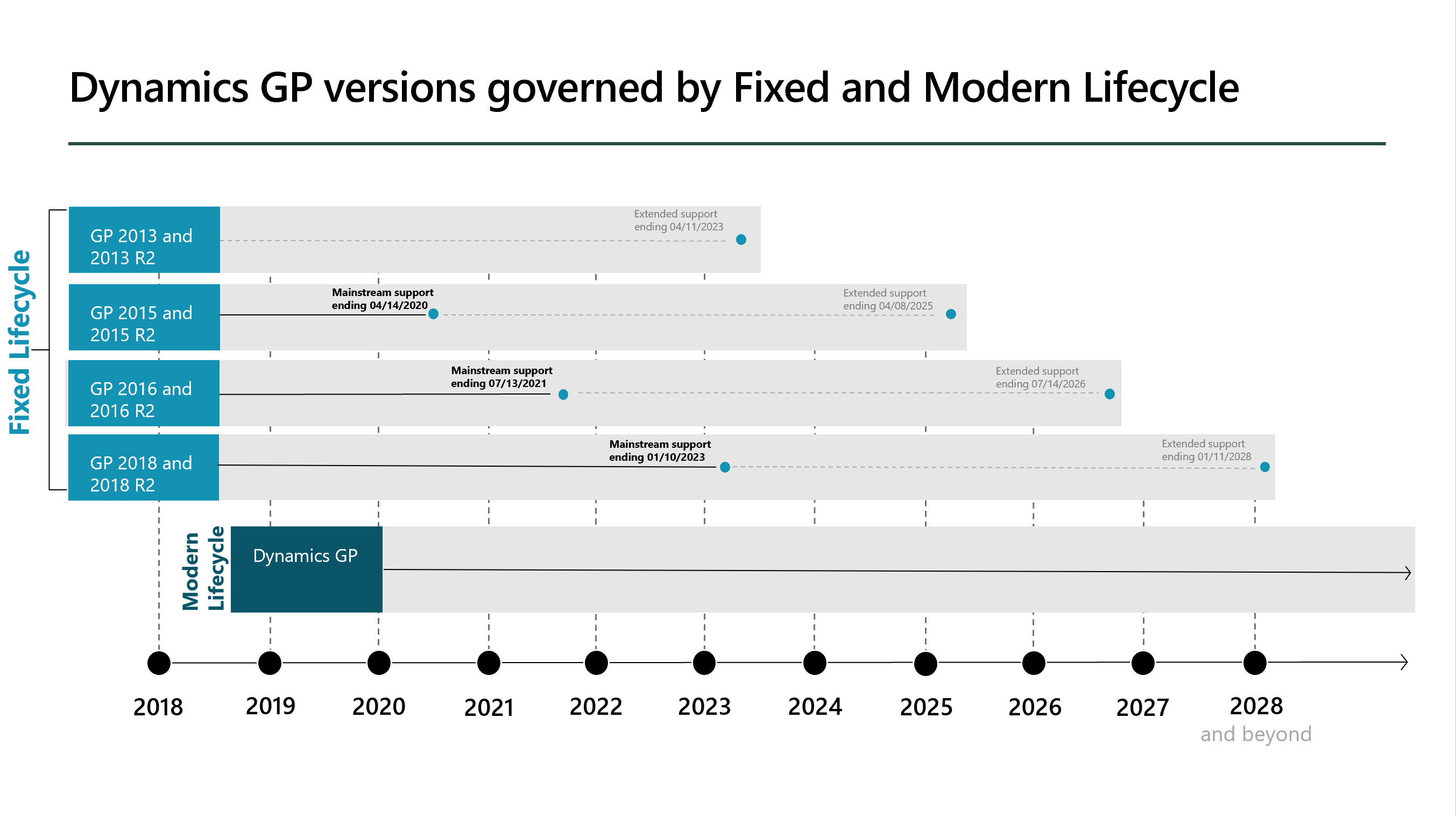

There’s no denying there was a big shift in working environments in March 2020, with virtual meetings, remote collaboration, and even online social events becoming commonplace. But don’t rest easy...

Read More