Microsoft Dynamics GP Year-End Update 2020: W-2 Tips and Tricks

This article was originally published by Microsoft.

W-2’s….oh I just love this time of year, I know you all do to! Use this blog to help you get your W-2’s out the door on time!! I’d like to remind you about some COOL W-2 features, and provide you with some basic information around how W-2’s work in Microsoft Dynamics GP, along with the most Frequently Asked Questions we see in support.

So let’s get started…….

Make sure to review this blog for specific instructions around COVID/FFCRA and Box 14 reporting changes in the 2020 Year-End Update.

Where does the information in the W-2’s come from?

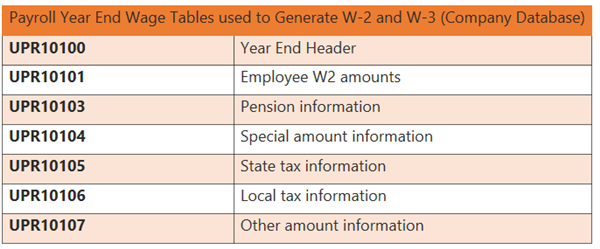

When a year is closed in the Payroll module, Microsoft Dynamics GP populates the Payroll Year End Wage tables, which are used to generate the Year-End Wage file to generate your W-2’s and W-3!!

If you need to make changes/edits to ensure W-2s are accurate after the year-end wage file has been created, you have a couple of options:

If you need to make changes/edits to ensure W-2s are accurate after the year-end wage file has been created, you have a couple of options:

Option 1 – Manually Edit W-2’s (most common):

Manually edit the W-2 via the Edit W-2 Information window (Microsoft Dynamics GP >> Tools >> Routines >> Payroll >> Edit W-2). *This is what most users do*:

Note: Changes made here will update the Payroll Year End Wage tables only and are not reflected in any other tables in the Payroll module. If you remove the Year End Wage File for any year, ALL edits made manually via the Edit W-2 Information window are lost. This is because removing the year-end wage file removes data from all of the Payroll Year End Wage tables for the year in question.

Option 2 – Remove Year-End Wage File, Make Changes, and Recreate Year-End Wage File:

*Remember, if you choose this option any manual edits you’ve already made on your W-2’s will be lost.

* Always make a backup of the databases prior to making any changes. *

- Ensure No users are processing in Payroll system wide.

- Remove the Year-End Wage file for the appropriate year (Microsoft Dynamics GP >> Tools >> Utilities >> Payroll >> Remove Year End Information).

- 2020 Tax Tables recommended.

- Make needed changes in Payroll (whether that’s voiding checks, processing checks, fixing W-2 labels, processing manual checks, etc.)

- Once you have verified all data is accurate, close the Payroll year again (2020 tax tables recommended).

- Verify changes updated the Year-End Wage file and W-2’s as desired.

- Make another backup.

- Re-install 2021 tax tables prior to any further processing in Payroll for the 2021 payroll year (Microsoft Dynamics GP >> Maintenance >> US Payroll Updates >> Check for Tax Updates).

W-2 Frequently Asked Questions:

QUESTION 1: What will happen if I have deductions and/or benefits set to print in the same box on the W-2 statement with the same label?

ANSWER 1: The amounts will be combined and print as one total.

QUESTION 2: Deductions, benefits, and/or pay codes are doubled/tripled on my W-2’s! Why, and how can I fix this?

This may also manifest with the following errors when you create the year end age file:

Payroll Year End – UPR_Year_End_WORK_Other failed. A record was already locked or Payroll Year End – UPR_Year_End_WORK_Special failed. A record was already locked

ANSWER 2: This happens when the ‘same’ W-2 label has been assigned to a particular pay code, benefit, or deduction more than once (you can assign up to 4 W-2 labels to each code). Please utilize the AWESOME blog Benefit, Deduction and/or Pay Code Amounts are Doubled on My W-2s to find and remove the problem duplicates so you can recreate your Year End Wage file with appropriate amounts! The record lock error seems to cause issues when we have many deductions and benefits assigned to employees with codes they are not using (zero amount for the year). You will be able to tell by the error message which employee is stopping the process and review their labels, especially look at duplicate labels for benefits and deductions and if they are needed, if not, remove. Example script check for box 14 and 12 labels

select W2BXNMBR, W2BXLABL, * from UPR00500 where EMPLOYID=’XXX’ select W2BXNMBR, W2BXLABL, * from UPR00600 where EMPLOYID=’XXX’ Also look at life to date amounts make sure there are no negatives. select LTDDEDTN, * from UPR00500 where EMPLOYID=’XXX’

QUESTION 3: Box 1 on the W-2 does not match Federal Wages in the Employee Summary window. Why, and how do I fix this?

ANSWER 3: It can be normal for Box 1 to differ from the Federal Wages in the Employee Summary window. All pay codes are added to ‘Gross’ under Cards >> Payroll >> Summary, even if the federal box is not marked on the pay code. However, most users do want these two values to match.

The calculation for Box 1 of the W-2 is as follows:

Gross Wages (from Employee Summary window) + YTD Benefits subject to Fed tax + Reported Tips + Charged Tips – YTD TSA Deductions

This is explained in more detail in the W-2 Data Source Document:

The only time a pay code is not added to ‘Gross’ is when the pay code is a ‘Business Expense’ pay type marked ‘not to be included as wages’, or when the pay code is a ‘Pension’ pay type.

It is very common for users to think pay codes not marked as subject to federal tax will not be included in Box 1. However, that is not the case. If you do not want a pay code amount to be included in box 1 you should set it up as a business expense pay code pay type.

Most commonly, users will see amounts in this field updated with unexpected amounts when:

- A pay code was not marked to be subject to federal wages, so you aren’t expecting the value to be included in Box 1.

- A deduction, a benefit, or a pay code may have been changed so that it is taxed instead of not being taxed, or vice versa. This change causes a difference in federal wages in Form 941/W-2’s and the Payroll Summary report. This change is not corrected during the reconcile process.

- A manual check was processed incorrectly (taxable wages and tax amounts not recorded).

See KB 862929 for more information around what can cause unexpected federal wages differences, along with how to fix the problem.

QUESTION 4: Where should I report the cost of coverage of an employer-sponsored group health plan on the W-2?

ANSWER 4: Applicable employer-sponsored group health plan values should be reported in Box 12 DD on the W-2. For more details see: https://www.irs.gov/affordable-care-act/form-w-2-reporting-of-employer-sponsored-health-coverage

To add a W-2 box and label to a specific Employee:

- Navigate to Cards >> Payroll >> Deduction or Benefit

- Pull up the appropriate Employee ID, and the appropriate Code.

- Next to W-2 Box: Use arrows to navigate to desired W-2 box space, and enter the appropriate W-2 box.

- Next to W-2 Label: Enter appropriate W-2 label.

Remember: There are 4 possible labels available for every deduction, so verify the label is assigned only once to avoid duplication of values – See FAQ 2. It would be recommended to keep the codes consistent at the setup level, versus changing them at the employee level, just roll it down from setup.

QUESTION 5: What is the source of the Employer Identification Number that appears as a default in the Print W-2 Forms window?

ANSWER 5: The EIN number is the federal or state ID entered in the Unemployment Tax Setup window (Microsoft Dynamics GP menu >> Setup >> Payroll >>Unemployment Tax) in the Unemployment Tax ID field.

QUESTION 6: In both the Edit W-2 Information and the Print W-2 Forms windows, there is a list used to select the year. Is there a limit to the number of years available? Also, is each year added to the year-end wage file, or does each year have separate year-end wage files created during the year-end closing process?

ANSWER 6: No, there is no limit to the number of years available. During the Payroll year-end closing process, the ‘year-end wage file’ is created. Multiple years of history can be saved. If you choose the same year twice when performing the process, the previous file will be replaced by the new file. As long as the correct year is entered each time, the new year’s information will be added to the file. This information can be cleared using the Remove Payroll Year-end Information window.

QUESTION 7: If I add information in the Edit W-2 Special Information window (Special button in the Edit W-2 Information window) without entering information in the Edit W-2 Information window, where will that information appear?

ANSWER 7: Microsoft Dynamics GP will print this special information on the additional W-2.

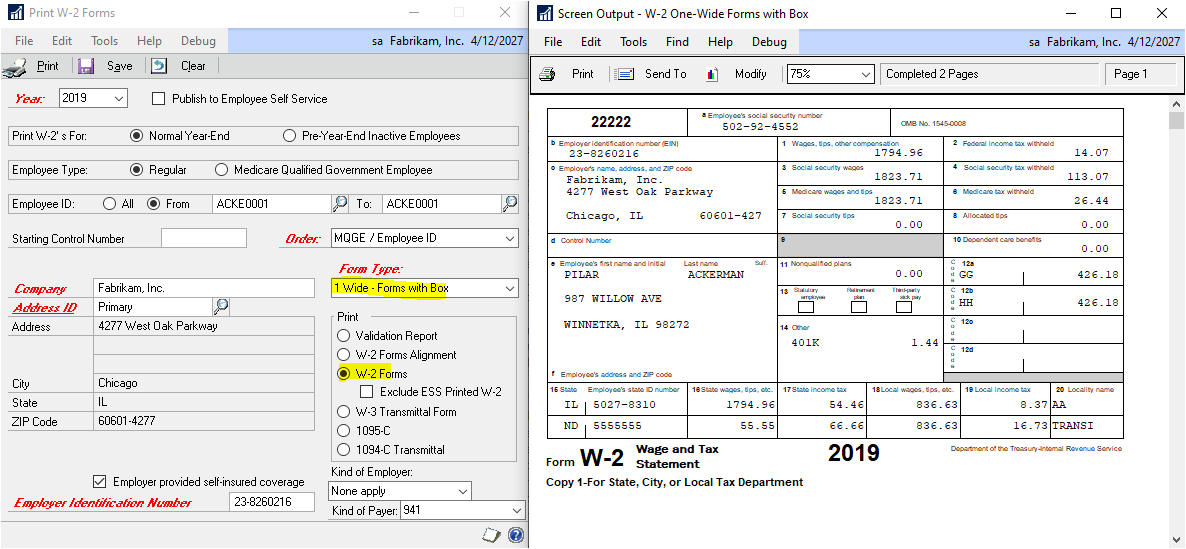

QUESTION 8: How do I print W-2 statements for Medicare Qualified Government employees?

ANSWER 8: The W-2 statements for Medicare Qualified Government Employees are printed separately from standard W-2 statements. To print W-2’s for MQGE employees, simply select the Medicare Qualified Government Employee option in the Employee Type box in the Print W-2 Forms window (Microsoft Dynamics GP menu >> Tools >> Routines >> Payroll >> Print W-2s).

QUESTION 9: I need to file W-2 corrections via a W-2c with the IRS. Can I print the W-2c in Microsoft Dynamics GP?

ANSWER 9: Microsoft Dynamics GP does not currently print the W-2c form. Note: Yearli Software (Formerly JAT Software) does offer additional functionality around this.

QUESTION 10: Can a W-2 be reprinted at the end of the year for an employee that had a W-2 print during the middle of the year, who is now inactive?

ANSWER 10: Yes, W-2s printed for inactive employees during the year will be reprinted when W-2s are printed at year end

QUESTION 11: Must the employee record be inactive before a special W-2 can be printed before the year end?

ANSWER 11: Yes

QUESTION 12: If I have employees that receive two W-2s because they have additional state, local tax, deductions or benefit information, will any other information print on the second W-2?

ANSWER 12: No, the only information that will print on the second W-2 is the employee address information, employer address information, and the additional information.

QUESTION 13: In edit W-2’s, what happens if I add some special items using the special button, but there is nothing on the first window?

ANSWER 13: It will print this information on the additional W-2. But, keep in mind that the W-2 will not print without wages. If a user needs to print a W-2 with only information in the special box, then they would need to manually process that W-2.

QUESTION 14: If your employer state ID number and employer unemployment ID numbers differ, do you need make changes to any information to print the employer state ID on the W-2s?

ANSWER 14: Dynamics GP allows you to maintain state ID numbers separate from unemployment ID numbers. So you won’t need to manually change the number back to your Unemployment ID number after creating the Year-End Wage file, or enter the Employer State ID number for each applicable employee’s W-2 information. You can verify the Employer State ID number is correct by referring to the Payroll Tax Identification Setup window (Microsoft Dynamics GP >> Tools >> Setup >> Payroll >> Tax ID).

QUESTION 15: Is Microsoft Dynamics GP going to make changes to accommodate locality + municipal code around local tax labels (ex: Ohio, Pennsylvania, etc.) on the W-2?

ANSWER 15: No, there were no changes made in Microsoft Dynamics GP. With that being said, you can certainly modify the Locality field in the Edit W-2 Local Tax Information window (Microsoft Dynamics GP >> Tools >> Routines >> Payroll >> Edit W-2s >> Local button). However, the Locality field is limited to 6 characters. If you require more than 6 characters to accurately reflect your Locality + Municipality, Greenshades does offer additional functionality around this.

QUESTION 16: I need to reprint a W-2 from a prior year. Can I do that in Microsoft Dynamics GP?

ANSWER 16: Yes, you can! You can print a W-2 for a prior year if the Year-End Wage file (Year-End Wage tables) still exists for that year. Simply choose the appropriate year from the Year drop down field in the Print W-2 Forms window. The new 1 wide W-2 with boxes and lines is a nice option for this feature as the prior year will print automatically on the form, no need to search for old W-2 forms.

QUESTION 17: What determines how many W2’s to print for an employee?

ANSWER 17: Once you create the payroll year end wage file and then print your W2’s to screen. If you do a select on the UPR10101 table for the employee look at this column w2bfsttl

It will be assigned an A, B, C, etc to determine how many W2’s to print. A=2, B=3 W-2 forms and so on.

select w2bfsttl, * from UPR10101 where EMPLOYID=’ACKE0001′ AND RPTNGYR=’2019′

QUESTION 18: For a few of my W2’s, I’m getting an extra W2 for no reason and it is blank, WHY?

ANSWER 18: This usually happens because of local taxes. You can query the UPR10106 table and for this employee that is printing a blank W2, verify they have a Sequence number of 1, 2 or 3, if they are missing a 1, that could be the problem. Sequence Number 1 pulls the local tax from Cards | Payroll | Tax, the field Local Tax Code. If you have a local tax code listed that is inactive for this employee and has no YTD wages, we can see this causing an issue on the W2. This should be blank (if you are automatically calculating local taxes) or set it to an active local tax for the employee that has YTD data.

select SEQNUMBR, * from UPR10106 where EMPLOYID=’ACKE0001′ AND RPTNGYR=’2019′

QUESTION 19: Should box 12DD print on the W-3 it seems to be missing?

ANSWER 19: Not every box and label that prints on the W-2 is summed on the W-3. Review the instructions for details but examples that do not print on the W-3 are codes A-C, J-R, T-W, Z, DD, FF, GG, and HH are not reported on the form W-3.

W-2 and W-3 Resources:

Year-end closing procedures for the Payroll module in Microsoft Dynamics GP are found in KB 850663.

- Year End Update detailed documentation

- W-2 Wage and Tax Statement Data Source

- W2 Form

- Tax Forms – 800-432-1281

- IRS Forms and Publications

- EFW2 Instructions

- W3 Instructions

- W3 Form

- Accuwage

- Payroll Documentation

Remember, with the release of Microsoft Dynamics GP 2016 R2, you have the ability print W-2’s with lines on blank paper!!!! The 1-Wide Forms with Box Form Type was added in the Print W-2 Forms window to accomplish this (Microsoft Dynamics GP >> Routines >> Payroll >> Print W-2’s >> Form Type = 1 Wide- Forms with Box >> Print = W-2 Forms):

Note: We only print the black form with lines, not the red form, but most customers electronically file so the red forms do not need to be purchased, just file electronic for FREE.

If you need to purchase forms (W2’s), we recommend to check out Microsoft Business Checks!

Be sure to refer to the 2020 Year-End Blog Schedule to review current and upcoming blog posts and other helpful resource links related to Year-End Closing for Dynamics GP.

I hope this is helpful and that you have a successful Year-End!! If you have any feedback or suggestions, please let us know.

Have a wonderful Year-End!!!

Thanks

Terry Heley

Microsoft