Microsoft Dynamics GP Year-End Update 2020: Payables Management form changes including the NEW 1099-NEC!!

This article was originally published by Microsoft.

Welcome to the end of 2020!!

Please review this blog to learn more about which payables forms have changed for the 2020 tax year, what those specific changes are, along with the most frequently asked questions we’ve seen on these changes in support. Enjoy!

What Payables Forms Changed for the 2020 year?

There are three payables form changes to be aware of this year:

- 1099-MISC form changes.

- 1099-NEC form (new).

- 1096 form modified to include NEC amounts.

Due Dates for 1099 form submittal/filing to the IRS can be found here: 2020 General Instructions for Certain Information Returns (irs.gov)

The most significant change (and where we’re seeing the most questions) this year is the breakout of NEC (Non-Employee Compensation) from Box 7 of Form 1099-MISC to its own Form: The 1099-NEC. Non-Employee Compensation payments are now reported Box 1 of the new 2020 Form 1099-NEC.

Here is more detail around what has changed for each payables form this year:

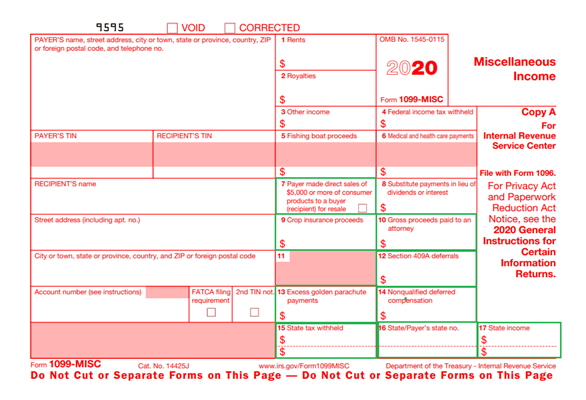

1099-MISC FORM CHANGES: 2020 Form 1099-MISC (irs.gov)

Boxes that have changed are highlighted in green. and the specific changes are noted below:

- Box 7: Checkbox to record whether Payer made direct sales of 5,000 or more of consumer products to a buyer (recipient) for sale

- 2019 form: Box 7 was used for Non-Employee Compensation (this box has been moved to box 1 on the new 1099 NEC form)

- Box 9: Crop insurance proceeds

- 2019 form: Box 9 was used to record whether Payer made direct sales of 5,000 or more of consumer products to a buyer (recipient) for sale

- Box 10: Gross proceeds paid to an attorney

- 2019 form: Box 10 was Crop insurance proceeds

- Box 12: Section 409A deferrals

- 2019 form: Box 12 was not used

- Box 14: Nonqualified deferred compensation

- 2019 form: Box 12 was used for Gross proceeds paid to an attorney

- Box 15: State tax withheld

- 2019 form: Box 15a was used for Section 409A deferrals and Box 15b was used for Section 409A income (neither 15a nor 15b exist on the 2020 form)

- Box 16: State/Payers state no.

- 2019 form: Box 16 was used for State tax withheld

- Box 17: State income

- 2019 form: Box 17 was used for State/Payers state no.

- Box 18 no longer exists on the 2020 form

- 2019 form: Box 18 was used for State income

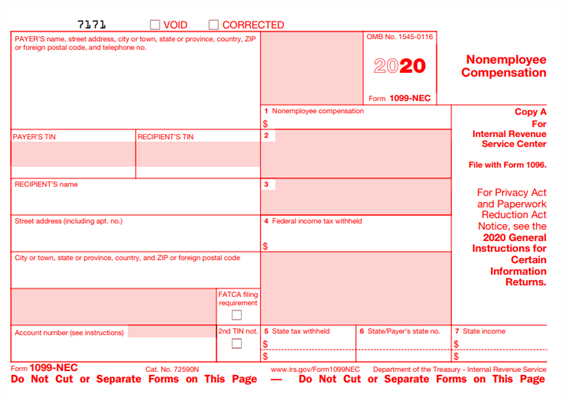

NEW 1099-NEC FORM: 2020 Form 1099-NEC (irs.gov)

Starting with the 2020 tax year: Nonemployee compensation amounts are to be reported in Box 1 of the 1099-NEC form instead of box 7 of the 1099-Misc form. The new Nonemployee Tax Type was introduced in GP with the release of the 2020 October Update (18.3.1173):

Here are more specifics about the boxes on the new 1099-NEC form:

Here are more specifics about the boxes on the new 1099-NEC form:

- Box 1: Nonemployee compensation

- Box 2: Not used

- Box 3: Not used

- Box 4: Federal income tax withheld

- Box 5: State tax withheld

- Box 6: State/Payer’s state no.

- Box 7: State income

1096 form: 2020 Form 1096 (irs.gov)

With the release of the 2020 Year-End Update (18.3.1200), the 1096 form has been updated to include the 1099-NEC summary amounts.

Additionally, Box 1099-NEC 71 has been inserted on the bottom line (highlighted in green below) between the 1099-MISC (95) and 1099-OLD (96) boxes. In 2019, there was an empty box on the right hand side of the bottom line on this form:

Frequently Asked Questions:

Question 1: Where can I find instructions for the 1099 MISC and 1099 NEC forms for the 2020 year?

Answer 1: Here is a link to the IRS instructions pertaining to the 1099 MISC and 1099 NEC forms for the 2020 year: 2020 Instructions for Forms 1099-MISC and 1099-NEC (irs.gov)

Question 2: What happens to the existing (and historical) vendor information in box 7 of the 1099 MISC form when we install the 2020 Year-End Update?

Answer 2: When you upgrade to version 18.3.1173, 18.3.1200, or 16.00.0814: ALL existing Box 7 1099 (nonemployee compensation) data for all existing years is automatically moved to Box 1 of the new 1099-NEC form. As such, users will not be able to print nonemployee compensation data on the 1099 MISC form (this includes prior year 1099 forms) after upgrading.

We highly suggest users print prior year 1099 MISC forms with nonemployee compensation box 7 data to a file prior to upgrading to a version where the new 1099-NEC form is used. The data from the saved file can be used to reprint nonemployee compensation box 7 data from prior years if needed.

If users couldn’t save historical 1099 MISC nonemployee compensation box 7 data to a file prior to upgrading, they can still see the historical nonemployee compensation data on the new 1099 NEC form. The data from Box 1 can be used as a guide to show amounts that were previously associated with box 7 on the MISC form in prior years.

Users can view prior year (prior to 2020) nonemployee compensation box 7 1099-MISC data in Box 1 of the 1099 Details window (Cards >> Purchasing >> 1099 Details >> Tax Type = Nonemployee Compensation >> Year = Less than 2020).

Question 3: Is there any guidance on what GP users should plan to do for reprints or corrected 1099’s from prior years?

Answer 3: The 1099 forms printed in Microsoft Dynamics GP will always be consistent with a specific version of GP in conjunction with the IRS guidelines in place at that point in time. This has always been the case in Microsoft Dynamics GP.

While GP does allow users to reprint historical 1099 forms from prior years, GP does not store old/historical 1099 form formats. As such, GP will always print the ‘current’ 1099 form regardless of the year the user chooses to print.

As a best practice, in case you need to reprint 1099 forms from prior years after the format of that form has changed in GP: We recommend you save the 1099 forms to a file each year (in addition to printing them). That way, if you need to reprint a 1099 after the format of the form has changed in the, you can simply reprint from the ‘file’ you saved when the form format matched the 1099 you printed at that time.

Question 4: Where does the 1099 information I see on the 1099 forms pull from?

Answer 4: Microsoft Dynamics GP pulls the data you see on the 1099 forms from the PM00204 (Purchasing 1099 Period Detail) table.

Question 5: Can I use the new 1099 NEC form to reprint and correct prior year (prior to 2020 tax year) nonemployee compensation amounts that were previously reported on the 1099 MISC form?

Answer 5: No. If you need to reprint or correct historical nonemployee 1099 MISC amounts, you must use the appropriate 1099 form for that specific tax year. Again, GP does not store historical 1099 tax forms. As such, if you did not save a copy of the printed historical 1099 form to a file prior to upgrading, you can use the 1099 Details window (Cards >> Vendor >> 1099 Details) to see prior year nonemployee compensation data (Box 1 of the Nonemployee Compensation Tax Type). However, you cannot physically print the old historical MISC form from GP. Rather, you can use the 1099 Details window data to manually fill out and submit the appropriate historical 1099 form instead.

Question 6: Can I print the new 1099-NEC form from GP if I don’t install the 2020 Year-End Update (or the 2020 October Update)?

Answer 6: No, it is not possible to print the new 1099-NEC form in Microsoft Dynamics GP until you upgrade to a version of GP where the new form exists (18.3.1173, 18.3.1200, or 16.00.0814). The changes for the new 1099-NEC form are BOTH dexterity code based, and forms based. You cannot print the new 1099-NEC form without the new dexterity code in place.

With that being said, the following Dynamics Partners are providing the ability to print the new 1099-NEC form without installing the 2020 Year-End Update. Feel free to reach out to these Partners for more information on this:

Aatrix: www.aatrix.com

Greenshades: www.greenshades.com

Question 7: When I try to integrate payables transactions with the new 1099-NEC tax type, it doesn’t work.

Answer 7: The new 1099-NEC tax type/boxes were not added to Integration Manager or eConnect and are not supported with those integration tools. If you’d like to see this functionality added to Integration Manager, and/or eConnect you can enter a product suggestion for that here:

https://experience.dynamics.com/ideas/

Question 8: I’m getting the following error when I install the 2020 Year-End Update, “Violation of PRIMARY KEY constraint ‘PKPM00204’. Cannot insert duplicate key in object ‘dbo.PM00204’” What should I do?

Answer 8: See our upgrade blog that talks about why this error occurs and how to fix it: (+) Microsoft Dynamics GP Fall 2020 Update – Known Upgrade Issues – Microsoft Dynamics GP Community

Question 9: I need to change both the vendor 1099 tax type and 1099 data before I print the 1099 this year. How can I do that?

Answer 9: You have a couple of options (we always recommend testing first in a test company with a copy of live data to ensure you get desired results):

Option 1 – Use the 1099 Utility to update 1099 tax types and amounts for a specific vendor(s):

- Click Microsoft Dynamics GP >> Tools >> Utilities >> Purchasing >> Update 1099 Information to open the Update 1099 Information window.

- Mark the radio button next to ‘Vendor and 1099 Transactions’.

- In the ‘From’ restriction on the left-hand side:

- Tax Type = the tax type you want to change/update

- 1099 Box Number = the box number you want to change/update

- In the ‘To’ restriction on the left-hand side:

- Tax Type = the tax type you want the vendor data to reflect

- 1099 Box Number = the box number you want the vendor data to reflect

- In the Range restriction: Be sure to enter a restriction here You can restrict on Vendor ID, Vendor Name, and/or Vendor Class, and then click the Insert button to insert the restriction. *IF you do not enter a restriction here, GP will try to update all vendors – so it’s important to restrict appropriately!

- Once you’ve verified your settings/restrictions are accurate click on the Process button to process the changes. A report will print where you can review the information that has changed.

Option 2 – Use the Edit 1099 Transaction Information window to modify specific 1099 tax types and boxes associated with specific transactions:

- Click on Transactions >> Purchasing >> Edit 1099 Information to open the Edit 1099 Transaction Information window.

- Enter an appropriate Vendor ID.

- Restrict by voucher number if desired.

- You can view 1099 Debit Transactions, Add Debit Transactions, or All Credit Transactions.

- Note: Each time you make a change to the data you’d like to view, be sure to click the ‘Redisplay’ icon at the top of the window!

- Use this window to change the Tax Type, the Box Number, and/or the 1099 Amount for a specific transaction.

- Once you’ve made appropriate changes click on the ‘Process’ button at the top of the window to process the changes.

Once you’ve changed 1099 data per the methods above, view the 1099 information in the 1099 Details window (Cards >> Purchasing >> 1099 Details) for the vendor and verify the information is accurate. Test printing the appropriate 1099, and verify the information is accurate.

Question 10: I receive an error Not privileged to run this report when trying to print the 1099-NEC form.

Answer 10: There are new security roles for the reports, if this is an upgrade you need to run the scripts to update the Roles and Tasks.

Review the below blogs based on version.

Assistance for Payables Year End Close and 1099’s:

If you are creating a case with the Technical Support Team, please refer to the routing below to ensure you are routed to the correct Professional for assistance:

Support Topic Selection: Financial – Payables Management

Sub-topic Selection: Year End Procedures

Resources:

- Microsoft Dynamics Payables Documentation

- Tax Forms – 800-432-1281

Be sure to refer to the 2020 Year-End Blog Schedule to review current and upcoming blog posts and other helpful resource links related to Year-End Closing for Dynamics GP.

I hope this is helpful and that you have a successful Year-End!! If you have any feedback or suggestions, please let us know.

Andrea Melroe | Sr. Technical Advisor | Microsoft Dynamics GP