Microsoft Dynamics GP Year-End Update 2020: U.S. Payroll

This article was originally published by Microsoft.

Well, it is 2020, we all got thru the 2019 new W-4 fiasco, now it is time to look ahead and 2020 will be a breeze right? This blog will go through the changes for U.S. Payroll to make sure your 2020 year end is a huge success!

The Year-End Update is always scheduled to be released mid-November. We release this update in November to ensure you have plenty of time to install prior to year-end. In Support, we are often asked if it is OK to install the Year-End Update even though 2020 payrolls are not completely processed. The answer to that is YES YOU CAN! We release the update early so you have plenty of time to install it!

This update is all inclusive of prior updates for Microsoft Dynamics GP 2016 and Microsoft Dynamics GP. This means it will include 18.2 and 18.3 if you are currently not on this version.

The 2021 Round 1 Tax Update (tax table update) is targeted to be available mid-December 2020.

*Do not install this tax table update until ALL pay runs for the 2020 year are completed.

The 2021 Round 2 Tax Update will be available mid-January 2021.

Please review all documentation in detail so you are well prepared for the year-end close, specifically around what has changed for this year.

Please Note:

- There is no year-end update for Microsoft Dynamics GP 2015.

- This is the last year-end update for Microsoft Dynamics GP 2016. Mainstream support for Microsoft Dynamics GP 2016 will end in July 2021.

When should the Year End Close process (not install) be done?

The Payroll Year End Close process should be done after all pay runs have been completed in the current year.

Due to the changes in 2020, the year end update should be installed and any COVID pay codes updated for Box 14 prior to closing the 2020 year for W2’s to be correctly labeled.

Are there any changes I should know about related to the Year End Update for Payroll?

There are NO W-2, W-3 or W-4 form changes! YEAH!

There are NO EFW2 electronic changes.

There are larger Affordable Care Act form and instruction changes (ACA)!!

Important to Note This Year:

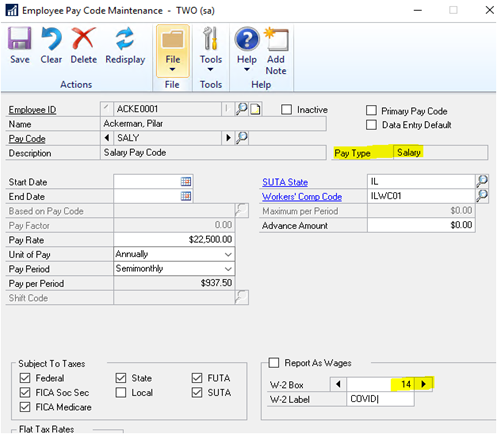

Once you install the 2020 year-end update you can now enter labels for Box 14 on all pay code pay types to report COVID/FFCRA (Families First Coronavirus Response Act) pay.

Prior to this update only the Business Expense Pay code Pay type allowed you to key in a W-2 label.

Employers are expected to separately report Qualified Sick Leave Wages and Qualified Family Leave Wages paid under the Families First Coronavirus Response Act[(FFCRA) on 2020 Forms W-2, Box 14, or on a separate statement.

In the screen shot below COVID is an example label, but should not be used as your label. This is available for ALL pay types not just Salary.

Once you install the update, go to the Setup of your COVID pay codes and properly put the Box 14 label on each code. When prompted to roll down to all employees choose YES.

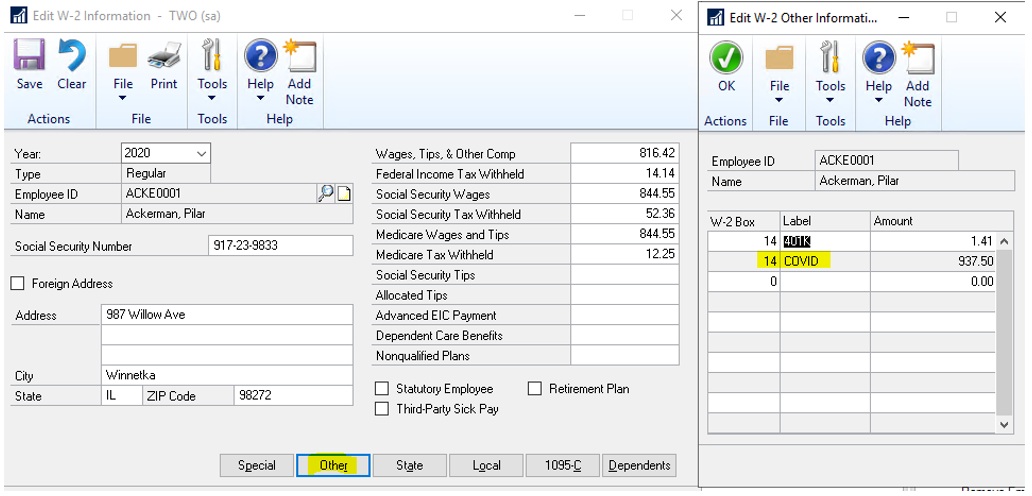

When you create the year end wage file it will report correctly on the W-2. If you do not install the year end update, you could edit each employees W-2 manually to enter this amount in Box 14.

Example of printed W-2

Example of printed W-2

What does the Year End Close process do?

Creates the Year End Wage file with annual wage information used to generate W2s, W3s, 1099’s, EFW2’s (aka Magnetic Media), 1095-Cs, and 1094-Cs for the year being closed.

What steps should I take to close the year? (See KB Article 850663 for detailed instructions on each step listed below):

**First and foremost, make a restorable backup of the company database so you can restore should you run into a problem.

- Complete all pay runs for the current year.

- Complete all month-end, period-end, or quarter-end procedures for the current year.

- Make a backup of the original file.

- Install the Year-End Update if it has not already been installed (we release early to give you plenty of time so install early if you can!!).

- Create the Year-End Wage file.

- Make a backup of the new file.

- Verify W-2 and 1099-R statement information.

- (Optional) Print the W-2 statements and the W-3 Transmittal form.

- (Optional) Print the 1099-R forms and the 1096 Transmittal form.

- (Optional) Create the W-2 Electronic file.

- (Optional) Archive inactive employee Human Resources information.

- Set up fiscal periods for 2021 (if they haven’t been set up yet).

- (Optional) Close fiscal periods for the payroll series for 2020.

- Install the payroll tax update (2021Round 1 Tax Update) for 2021.

Resources:

- Year-end closing procedures for the Payroll module in Microsoft Dynamics GP are found in KB 850663.

- Year End Update detailed documentation

- W-2 Wage and Tax Statement Data Source

- W2 Form

- Tax Forms – 800-432-1281

- IRS Forms and Publications

- EFW2 Instructions

- W3 Instructions

- W3 Form

- Accuwage

- Payroll Documentation

Here are the 2020 Year-End Update pages which will provide you with documentation and installation instructions you’ll need for a successful year-end:

2020 U.S. Payroll Year-End Update Download Pages:

Here are the pages on which you can access the latest (and previous) Tax Updates:

Year-End Close Resources:

Be sure to refer to the 2020 Year-End Blog Schedule to review current and upcoming blog posts and other helpful resource links related to Year-End Closing for Dynamics GP.

I hope this is helpful and that you have a successful Year-End!! If you have any feedback or suggestions, please let us know.

Have a wonderful Year-End!!!

Thanks

Terry Heley

Microsoft