Updating 1099 Information – Microsoft Dynamics Great Plains (GP) Year End Procedures

Changing the vendor 1099 tax type and/or 1099 data in Microsoft Dynamics GP (Great Plains) before printing the 1099 this year will not update 1099 amounts for vendors – either to add as a 1099 vendor or remove as a 1099 vendor.

You have two options to update the amounts.

Option 1 – Use the 1099 Utility to update 1099 tax types and amounts for a specific vendor(s):

-

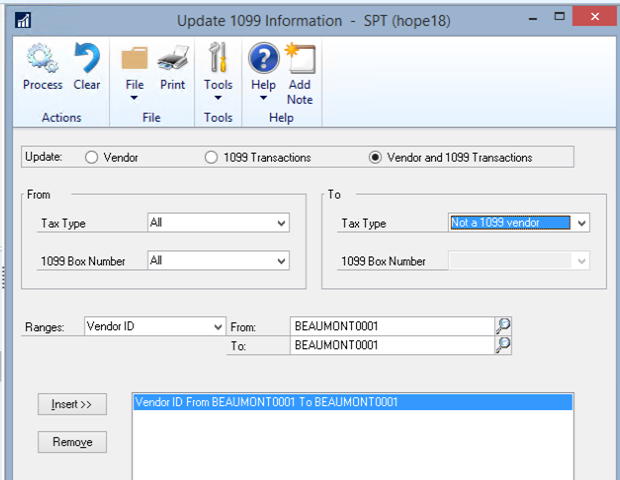

- Click Microsoft Dynamics GP >> Tools >> Utilities >> Purchasing >> Update 1099 Information to open the Update 1099 Information window.

- Mark the radio button next to ‘Vendor and 1099 Transactions’.

- In the ‘From’ restriction on the left-hand side:

- Tax Type = the tax type you want to change/update

- 1099 Box Number = the box number you want to change/update

- In the ‘To’ restriction on the left-hand side:

- Tax Type = the tax type you want the vendor data to reflect

- 1099 Box Number = the box number you want the vendor data to reflect

- In the Range restriction: Be sure to enter a restriction here. You can restrict on Vendor ID, Vendor Name, and/or Vendor Class, and then click the Insert button to insert the restriction. IF you do not enter a restriction here, GP will try to update all vendors – so it’s important to restrict appropriately!

- Once you’ve verified your settings/restrictions are accurate click on the Process button to process the changes. A report will print where you can review the information that has changed.

Option 2 – Use the Edit 1099 Transaction Information window

To modify specific 1099 tax types and boxes associated with specific transactions:

-

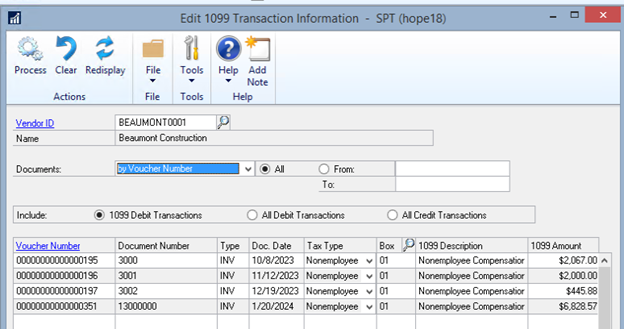

- Click on Transactions >> Purchasing >> Edit 1099 Information to open the Edit 1099 Transaction Information window.

- Enter an appropriate Vendor ID.

- Restrict by voucher number if desired.

- You can view 1099 Debit Transactions, Add Debit Transactions, or All Credit Transactions. Note: Each time you make a change to the data you’d like to view, be sure to click the ‘Redisplay’ icon at the top of the window!

- Use this window to change the Tax Type, the Box Number, and/or the 1099 Amount for a specific transaction.

- Once you’ve made appropriate changes click on the ‘Process’ button at the top of the window to process the changes.

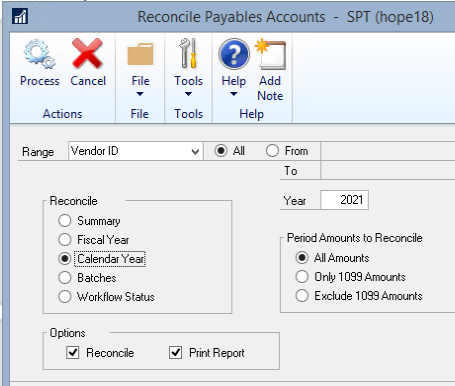

If the amounts are still not showing correctly on the 1099 Edit List, go to Purchasing, Utilities, Reconcile:

-

- Select All Vendors or a range of Vendors

- Select Calendar Year,

- and either All Amounts or Only 1099 Amounts.

- Click Process

If you need additional assistance, then get in touch with our support team!