Microsoft Dynamics GP – 1099 Form Changes for 2022

This blog is an excerpt from Microsoft Dynamics GP Year-End Update 2022: Payables Management 1099 Form changes.

What changes can you expect for 1099 forms in Microsoft Dynamics GP (Great Plains) this year?

The IRS has removed the pre-printed YEAR on all the forms, so GP will now print the year on the forms (1099-INT, 1099-DIV, 1099-MISC, and 1099-NEC)

- The 1099-MISC had some boxes moved around on the form and some boxes have been renumbered on the 1099-MISC and 1099-DIV forms.

- Did you know that you can now print the1099-NEC form WITH LINES? !! No need to buy preprinted 1099-NEC forms any longer. See details below.

What new features should I be aware of this year in Dynamics GP?

1. You will now need to enter the 1099 YEAR in the Print 1099 window in Dynamics GP as highlighted below. The system will then print the specified year on all the printed forms (1099-INT, 1099-DIV, 1099-MISC and 1099-NEC).

- With the October 2022 release (and included in the 2022 Year-end release), you can now print the 1099-NEC form WITH LINES! Now when you select to print the 1099-NEC form, you have the option of printing the form ‘One-Wide with Box‘ on blank paper (as shown in the screen-print above in the red box.)

If you are printing on pre-printed forms, and ALL fields on the report need to be moved in the same direction (up/down/left/right), you can test the following:

- Print the 1099 forms to the screen.

- In the Screen Output window, click Print.

- In Print Dialog box, adjust the horizontal and vertical alignments in the ‘Alignment (Inches)’ section according to the following scenarios:

- If the form prints too high, enter a positive vertical adjustment (.25 equals one line).

- If the form prints too low, enter a negative vertical adjustment (-.25 equals one line).

- If the form prints too far to the right, enter a negative horizontal adjustment.

- If the form prints too far to the left, enter a positive horizontal adjustment.

Specific 1099 Form Changes

1099-MISC FORM: Form 1099-MISC (Rev. January 2022) (irs.gov)

The 2022 Year-End Update includes the following changes for the 1099-MISC form as highlighted below:

- The IRS removed the ‘preprinted YEAR’ from the form and separated that box into two boxes where the upper box contains the words “Form 1099-MISC‘ with the revised date noted below it, and the lower box is populated with a fillable field: ‘For calendar year 20___‘ field, which is designated by the user in Dynamics GP.

- The Account Number box and 2nd Tin not. boxes have both been moved down a line, leaving the FACTA filing requirement box by itself on the line above, with an empty box to the left of it.

The FATCA Filing requirement box has now been labeled as Box 13, pushing boxes formerly labeled as 13,14,15,16 and 17 to now be relabeled as boxes 14,15,16,17 and 18.

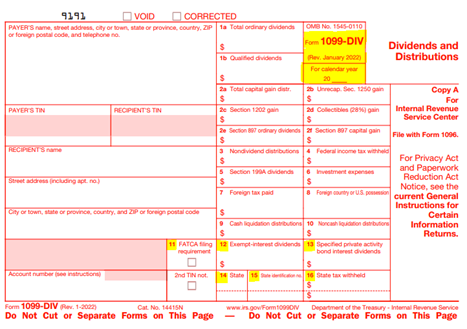

1099-DIV FORM: 2022 Form 1099-DIV (irs.gov)

The 2022 Year-End Update includes the following changes for the 1099-DIV form as highlighted below:

- The IRS removed the ‘preprinted YEAR’ from the form and separated that box into two boxes where the upper box contains the words “Form 1099-DIV‘ with the revised date noted below it, and the lower box is populated with a fillable field: ‘For calendar year 20___‘ field, which is designated by the user in Dynamics GP.

- The FATCA Filing requirement box has now been labeled as Box 11, pushing boxes formerly labeled as 11,12,13,14 and 15 to now be relabeled as boxes 12,13,14,15 and 16.

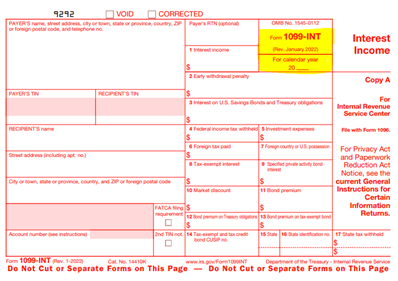

1099-INT FORM: Form 1099-INT (Rev. January 2022) (irs.gov)

The 2022 Year-End Update includes the following changes for the 1099-INT form as highlighted below:

- The IRS removed the ‘preprinted YEAR’ from the form and separated that box into two boxes where the upper box contains the words “Form 1099-INT‘ with the revised date noted below it, and the lower box is populated with a fillable field: ‘For calendar year 20___‘ field, which is designated by the user in Dynamics GP.

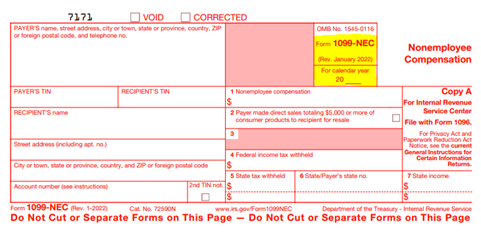

1099-NEC FORM: Form 1099-NEC (Rev. January 2022) (irs.gov)

The 2022 Year-End Update includes the following changes for the 1099-NEC form as highlighted below:

- The IRS removed the ‘preprinted YEAR’ from the form and separated that box into two boxes where the upper box contains the words “Form 1099-NEC‘ with the revised date noted below it, and the lower box is populated with a fillable field: ‘For calendar year 20___‘ field, which is designated by the user in Dynamics GP.

If you need additional assistance, then get in touch with our support team!